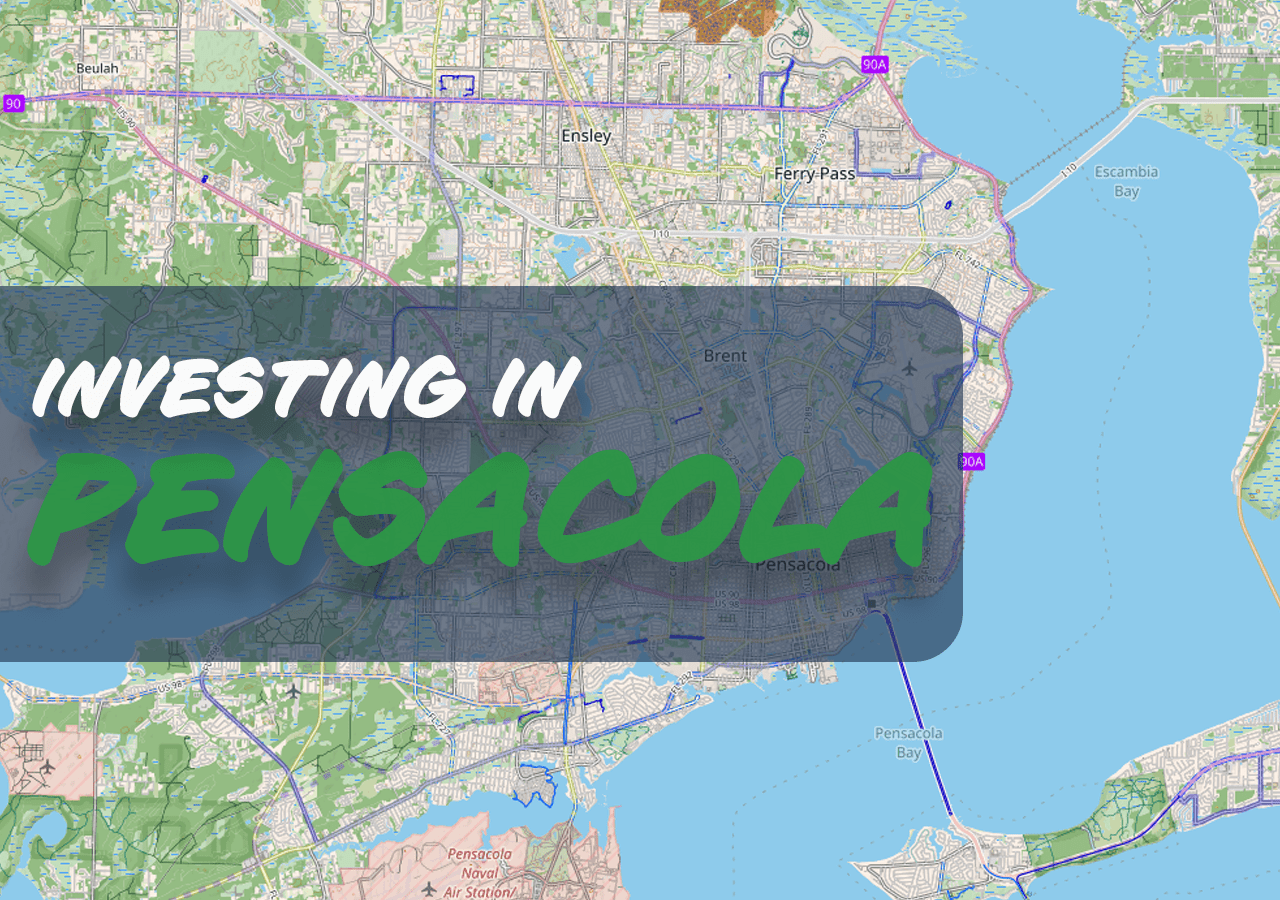

Why Pensacola is a Hidden Gem for Rental Property Investment in 2026

Rob Brooks

Rob is a property manager with Rob Brooks Realty property management.

A good rental property investment strategy is anchored on deep knowledge of a city, economy, neighborhoods, and renter persona. I’ve been working in real estate since 1994 and have helped my clients invest in rental properties and, more importantly, avoid bad rental property choices in Pensacola. I own my own property in this city, and draw on this experience to inform my perspective on this article.

What follows is my summary of the rental property investing scene in Pensacola, and my outlook for 2026.

Trends in Job Growth, Population Growth & Florida Popularity

It’s important to take a macro perspective of an area. What types of job opportunities are available? What types of people do these jobs attract? Is the population growing or shrinking? These are long-term factors that directly affect a long-term investment like rental properties.

Job market growth in the military and medical fields

Over the past twenty years, Pensacola has successfully driven job growth while many industries nationwide, including military sectors, have retracted. Military bases are a huge economic anchor in Pensacola. Contrary to the national trend of base closures, the Naval Air Station (NAS) Pensacola has seen recent growth in its number of employed military personnel. This sustained military footprint encompasses the main NAS station and major components like Whiting Field.

Pensacola also has Navy Federal Credit Union, which has shown a lot of growth. They have a large operational center in Pensacola and employ over 10,000 people. They’ve invested money in this area and have upgraded their physical infrastructure in town. Navy Federal is also known for paying its employees decently.

You want a place where there are good jobs for the people you want to rent to.

We have other industries that have remained strong as well, including our medical industry. We have a few hospitals here (Ascension Sacred Heart, Baptist Hospital, among others), and we have other industries, some technology-related, that continue to be strong.

Bottom line: The job market is very good, and that’s important when you’re looking for a place to invest. You want a place where there are good jobs for the people you want to rent to.

Lower median home prices (lower price point for investing)

Meanwhile, the median home price in Pensacola tends to be one of the lower median prices compared to the rest of Northwest Florida (and much less than what a lot of other metropolitan areas). So, an investor can get in for a lower price in Pensacola and have a good investment. In other cities or locations in Northwest Florida, you’re going to have to pay a higher price point to get into the rental market.

Population growth & popularity of Florida

Population growth continues as these jobs continue. In the 1970s, 1980s, and 1990s, the impression was that the area was losing population. Now, the Pensacola metro area has been seeing a large population increase.

And there are a lot of reasons for that. It’s a great place to retire and has some of Florida’s best beaches. Some also moved to Florida for political reasons. People are moving to Florida. The Panhandle is positioned not too far away from other populated states like Tennessee or Texas, so they can still travel a reasonable distance to see the grandkids or family members.

Rent Prices

The goal is to have steadily increasing rent prices. As the value of incomes and assets increase, you want rents to increase too.

Rent prices in the Pensacola area mirrored the rapid increases in sale prices that occurred in 2021 and 2022, though rents lagged slightly due to the nature of 12-month leases. During this period, the fundamental issue was a national shortage: more households than houses, which drove competition among both buyers and renters.

While that competition has calmed, the imbalance persists because builders have not kept pace. They’ve been opting to build apartments. This provides a strong opportunity for investors, as many people prefer single-family houses over apartments.

I expect annual rent increases at the same rate as house appreciation, which I project to be 4.59%.

Just as home sale prices have leveled off from 2023 through 2025, rent prices have done the same, particularly in 2024 and 2025. I believe this stabilization is temporary. Despite small, seasonal blips (often related to military-driven move-in/move-out cycles), rents overall will continue to increase.

I advise investors to expect annual rent increases at the same rate as house appreciation, which I project to be 4.59%.

Recommended Neighborhoods

On a micro level, there are a couple of neighborhoods I would look at when looking to get rental properties in Pensacola.

Recommend ✓

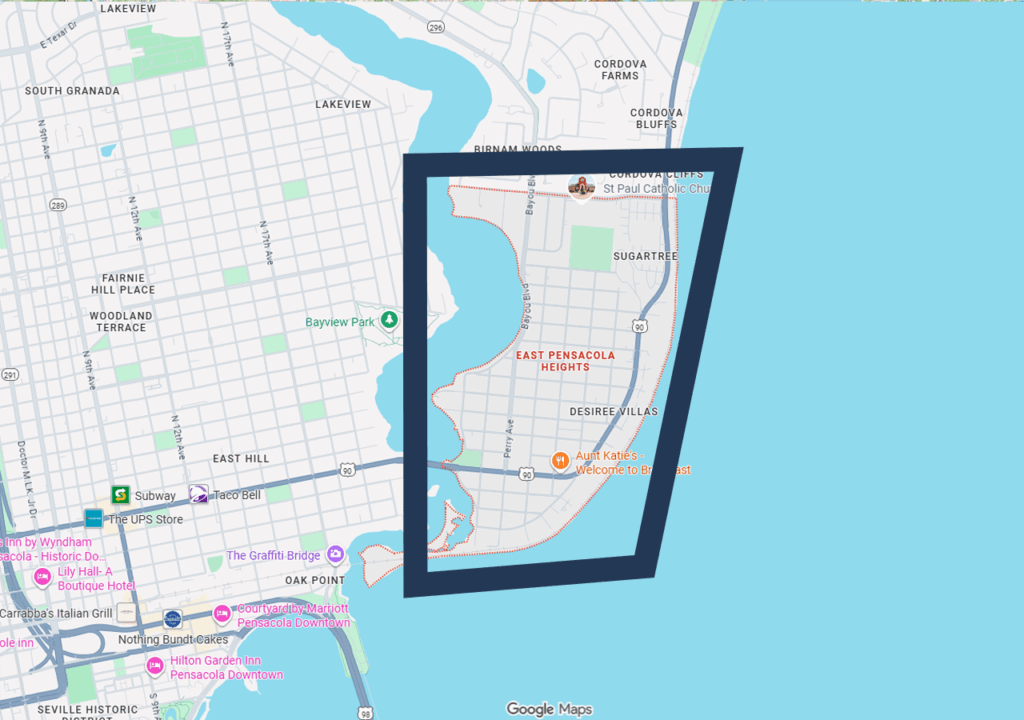

East Pensacola – I’ve seen the greatest return on investment in East Pensacola (not to be confused with East Hill). A lot of homes have lower maintenance with good entry prices.

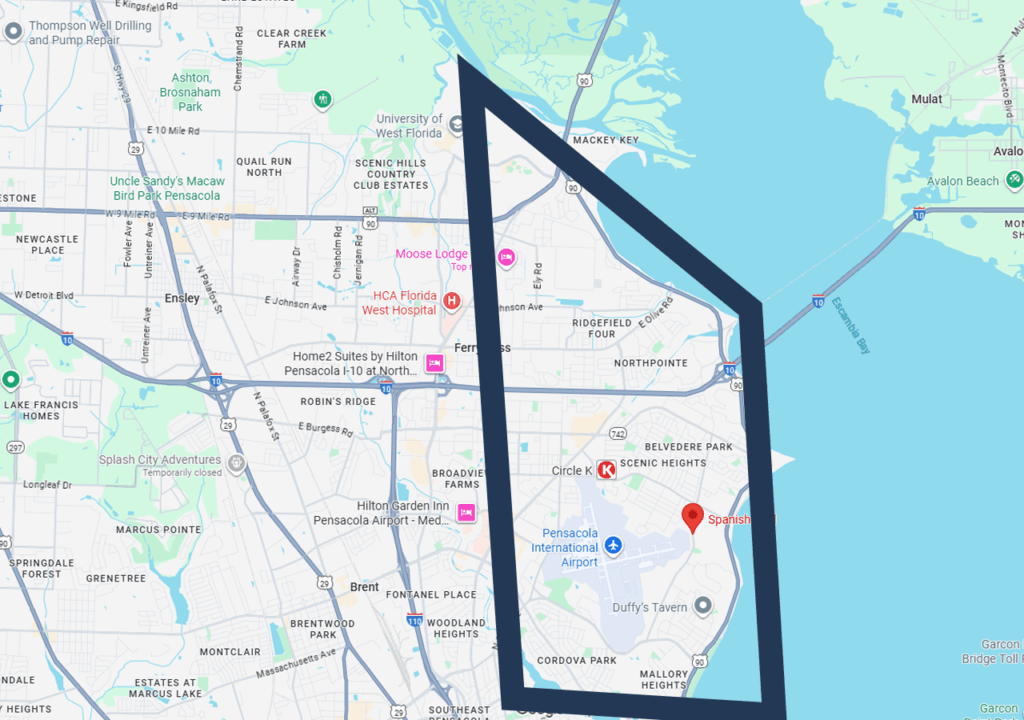

Spanish Trail – While there are some higher-priced homes that have been built in the past 20-30 years, I would not invest in these. These are beautiful and are in a great part of town, but don’t have a good rate of return when the numbers are run. Scenic Heights tend to be more affordable, all of the houses that are 10 or 20 blocks off Scenic Drive. From Spanish Trail, all the way up from Bayou, past I-10, up to the University of West Florida. At the time of this writing, anything below $300k would be a good investment in 2026.

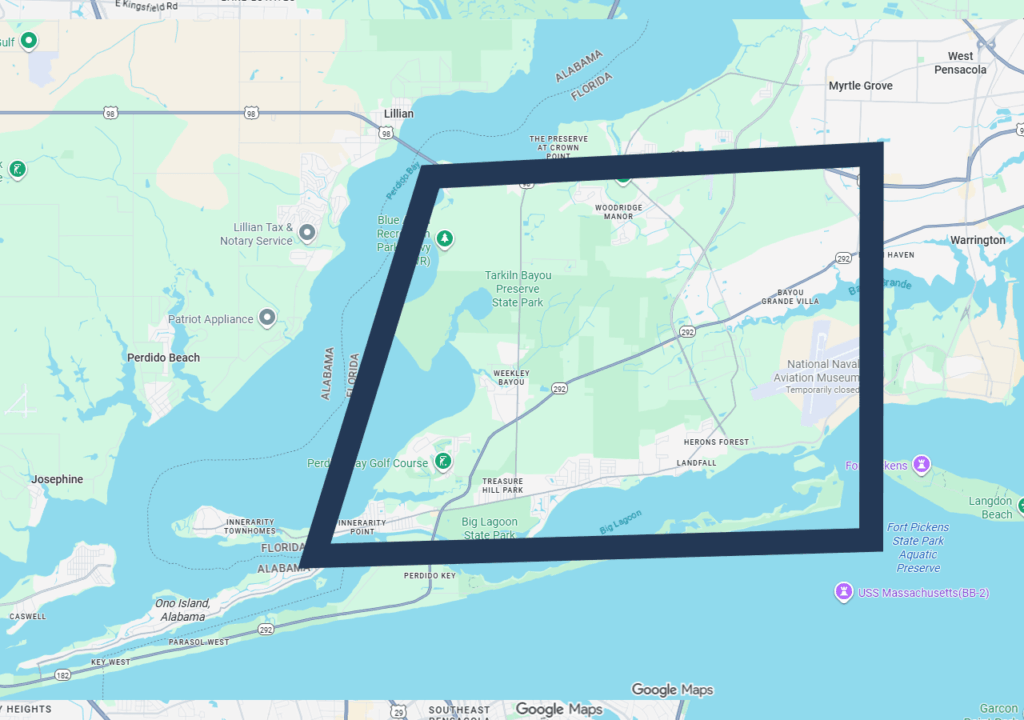

Far West Pensacola – To put a finer point on it: on the other side of the Naval Air Station, to the west of the Naval Air Station, and to the north of Perdido Key. This can be a good area for investment. A lot of military or retired military personnel like this area due to its closer access to the beach. The only concern here is the flood zone, and taking a close look at the risk for each property.

Do Not Recommend ✕

East Hill – Very beautiful, historic homes with a lot of character. But these tend to be more expensive and come with a TON of expensive maintenance issues. These houses were built in a period before vinyl or Hardie board even existed. There are a lot of older features, like wiring and plumbing, that need to be replaced in a large number of these homes.

Cantonment & NW Pensacola – While I like Cantonment and Northwest Pensacola and have a few personal investments there, it may not be a great place to invest today. Why? Because there is so much builder activity. I think that renter demand will increase, as always, over the decades in those places. But supply will also increase at close to the same rate. So there’s not going to be the same level of benefit that happens when demand outstrips supply.

Target Renter Persona

Your goal as an investor with a rental property in Pensacola should be to appeal to the responsible, blue-collar worker who is looking for a home where they can be proud to raise their family. This means it needs to be at the intersection of (a) reasonable affordability and (b) low crime. I always recommend looking at crime maps available online and using Google Street View to get an idea of the neighborhood.

Infrastructure & Development Projects

Development projects always get brought up in the discussion on the strategy for selecting an area for rental properties.

Ideal historical investing locations

5 years ago – Owning rental property near the new Baptist Hospital location

10 years ago – Owning rental property near Navy Federal Credit Union

15 years ago – Owning rental property near downtown

A general word of caution on this topic: You don’t know how the effect of a development project on rental prices will be until the thing is actually built. Things can be in the “talking stage” even before ground is broken. Even if the project starts construction, you don’t truly have an idea of what effect it will have on the area until the development is complete.

Plus, by the time the details of a development hit the newspaper, it’s likely too late ,and seasoned investors and institutional investors have already staked out their positions.

Don’t hang your entire investment strategy on speculative construction projects.

That being said: I’ve seen a few areas that would have been good areas to own property in based on larger development moves from a historical perspective (hindsight is 20/20).

Ideal historical investing locations

5 years ago – Owning rental property near the new Baptist Hospital location

10 years ago – Owning rental property near Navy Federal Credit Union

15 years ago – Owning rental property near downtown

Type of Property in Demand in Pensacola

Pensacola has a lot of demand for housing in general, and builders have worked to meet that demand (mainly with apartments). In general, people prefer owning their homes rather than renting, but there are some very specific scenarios where people want to rent a single-family house.

Who is renting single-family homes? Those not in a position to own (yet). They may want a house in the future. They may be building up cash reserves and only need the house for two or three years. They also likely want a backyard that is usable for pets and kids. You can serve these people with your investment.

What about Duplexes and Townhomes? These can be an interesting option to get in on an investment for less money than a single-family home. But, you lose some of your pool of potential renters due to a lack of privacy, a lack of yard, etc. If you are going to go the Duplex route, make sure there is some form of usable yard on the property.

Investing Insights Unique to Pensacola

Three things to keep in mind when considering Pensacola as your base for rental property investing:

- Pensacola is not a primary market (unlike St. Petersburg or Miami), and thus it’s often overlooked by institutional investors.

- Insurance costs are a little higher in Pensacola than in some places, mainly just because it’s in Florida and somewhat closer to the Gulf of America. It’s really no higher than most Florida cities, from what I know.

- Pensacola has less short-term rental saturation compared to other areas.

Wrapping Up

If I had to paint a picture of Pensacola, it’s an area that remains affordable, while still having a great upswing. I like the word “upswing” because while we have seen a lot of things that have happened downtown and in the surrounding areas, and downtown seems to be kind of the flagship of what’s going on in our area, there is a momentum that can be felt.

I expect to see a lot of growth in Pensacola for years to come.

How to Evaluate a Property Management Company [Full Vetting Process]

Start a conversation with our team

Let us help you think through the best strategy for your property. Get in contact with our property management team today.